Investment Calculator USA

Estimate the future value of your investments based on initial amount, interest rate, and time period.

Frequently Asked Questions (FAQ)

1. What does this calculator do?

It estimates the future value of your investments based on interest rate and compounding frequency.

2. Can I change the compounding frequency?

Yes, choose annually, quarterly, or monthly compounding.

3. Is this suitable for all types of investments?

This calculator is suitable for fixed-return investments, not for stocks or volatile markets.

llions of Americans are actively searching for methods to increase their savings through stocks, bonds, mutual funds, retirement accounts, and other investment alternatives since investing is one of the most dependable ways to create long-term wealth. But investment planning often involves variables like interest rates, compounding periods, contribution amounts, and growth projections–all of which can be confusing for the average investor. This is precisely where an Investment Calculator will prove very useful.An Investment Calculator is a user-friendly online service that enables you to model the value of your investments in the future depending on the amount of money you will invest, expected rates of returns, and the timeframe. It eliminates the guesswork and provides you with clear financial insights to enable you to make better investing decisions.

An investment calculator is defined as a tool that computes the value of an investment.

An Investment Calculator is a digital tool that estimates how much your money could grow over time. It usually needs a couple of inputs that are needed:

- Initial Investment (Principal): The amount at which you begin.

- Monthly/ Annual Contributions: Extra amount you intend to contribute after every month or year.

- Expected Annual Return Rate: The percentage your investment is projected to grow each year.

- Investment Duration: Years that you intend to invest.

- Compounding Frequency: Monthly, quarterly or once per year.

Based on such information the calculator will calculate the future value of your investment and in most cases will give a detailed analysis of contributions versus returns.

The Advantages of an Investment Calculator.

- Displays the Compounding Power.

One of the strongest instruments of investing is compounding, or the returns on your returns are returns on their own. The calculator highlights this effect, showing how even small contributions grow significantly over time.

- Compare Two or More Investment Strategies.

Will you make a lump sum investment upfront or make monthly contributions? Are you more a high-risk, high-reward portfolio or a stable and conservative portfolio? With a flick of the variables, you are able to compare results immediately.

Establishes Realistic Financial Expectations.

Investment performance can vary, but calculators help set expectations by modeling potential growth. Scenaries such as best-case and worst-case return rates can also be run.

The main Characteristics of a Good Investment Calculator.

The strong Investment Calculator usually offers:

- Future Value Estimates

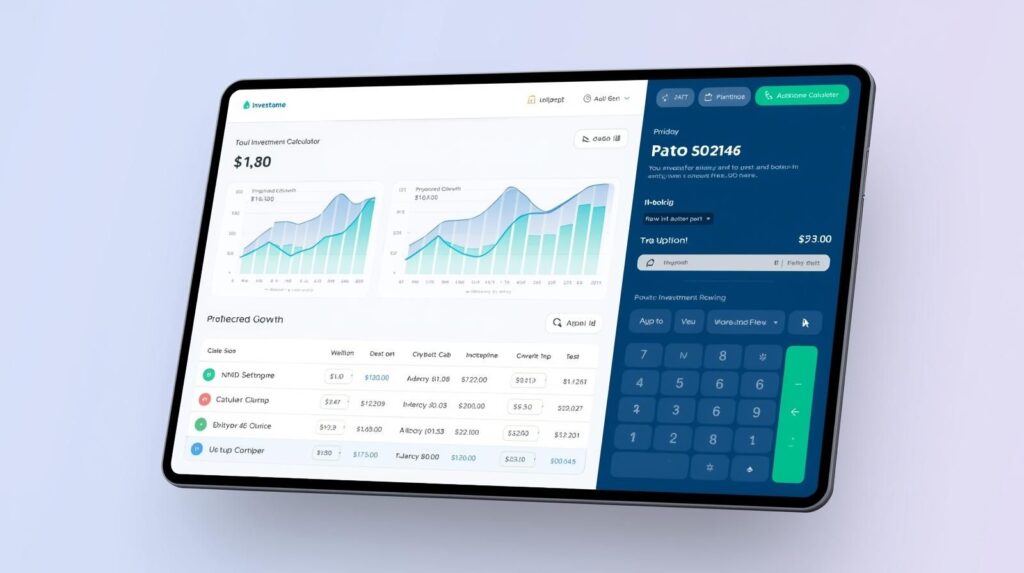

- Growth Charts and Graphs

- Contribution/ vs. Return Breakdown.

- Personalized Compounding Modifications.

- Inflation Adjustment

- Risk Scenarios

- Projections of Retirement Goals.

Most of the online calculators have the sliders that one can use to adjust the numbers and download the reports in future.

The Reason Americans trust Investment Calculators.

- Growing Financial Awareness

The more the people of the U.S. have become financially literate, the more they are now taking the initiative to plan their future, be it in purchasing a house, education, or early retirement. Investment calculators support these goals by providing clarity on how savings grow.

- Rise in Digital Investing

Investing in apps such as Robinhood, Vanguard, Fidelity and Acorns has made investing accessible to all. Investment calculators are the complements to these platforms because a user can predict the results of their investment decision before making it.

- Volatile Markets

As a high level of market fluctuation is becoming the norm, individuals desire to examine returns that may be made prior to investing. The calculator helps simulate different growth rates, making decision-making more informed and less emotional.

The Guide to using an Investment Calculator.

- Initial Investment:

Begin with the size you have already saved or you intend to invest now.

- Add Monthly/ Annual Contributions:

Include regular contributions to understand long-term growth more accurately.

- Stipulate a Return on the Investment:

This rate is based on the type of asset:

- Shares: 7-10 percent long term average returns.

- Bonds: 3-5%

- Balanced portfolios: 5-7%

- Choose Investment Duration:

The compounding power is increased by longer periods.

- Compounding frequency:

Monthly compounding normally has high returns as compared to annual compounding.

- Review the Results:

Projections, charts and contribution summaries of the study. Test the values to get the most optimal savings strategy.

Who is advised to use an Investment Calculator?

This tool is helpful for:

- New investors with small investments.

- Those intending to save towards retirement.

- Saving parents towards college.

- Wealth-building long-term investors.

- Any person who is comparing two or more investment plans.

- Individuals who monitor their financial freedom.

Final Thoughts

Investment Calculator is not a mere financial instrument, but it is a map to long term financial freedom. It makes complicated computations easy, it can make you realize the power of compounding and you can calculate the various situations without hesitation. Whether you’re saving for retirement, planning large future expenses, or simply trying to grow your wealth, this calculator offers clarity, direction, and motivation.It will help Americans make wise choices, remain disciplined by making contributions and create a secure financial future with its help and constant use.