EPFO, also known as Employee Provident Fund Organisation, is a government-owned statutory entity administered through the Ministry of Labour and Employment. EPFO (EPFO Login ) is responsible for the oversight and management of the Provident Fund (PF) in India. A UAN, also known as a Universal Account Number also known as UAN is a unique ID used to log in to EPFO Login and access all information regarding this account. EPFO (Employee Provident Fund) Fund (EPF) and EPFO Member Login. Interestingly, the PF money could also be used to purchase a brand-new house and repay a mortgage. With certain restrictions, the EPFO Member may use the PF money to buy land and construct a home. Use EPF to Finance Your New House.

The EPFO Login is done via a UAN (EPFO UAN Login). An EPFO Member can also use the UAN login to access their UAN Passbook on the internet (EPFO Members login). Since UAN is required to access the EPFO Member’s information, the EPFO Member can use an EPFO Member login (Epfo login) to obtain an access code to their UAN passbook. So here is a guide to using EPF to Finance Your New House.

Update June 2022: As an upcoming development, it has been announced that the Union government has lowered the interest rates of the employees’ Provident Fund Account (also called the PF account). In 2021-22, the interest on accounts in the EPFO account (EPFO Member Portal) will be paid at a lower amount, 8.1 percent. The lower interest rates will impact more than five million members of PF accounts (EPFO Members) throughout India.

Let’s look at the specifics regarding EPFO Login (Epfo login) and UAN EPFO.

What exactly is UAN?

UAN, also known as Universal Account Number, is a unique number assigned to salaried employees covered by the Employee Provident Fund program. The UAN gives users access to the EPFO account, passbook PF contributions, and balance checks for the EPF account. Because it is a unique number, UAN can be transferred if the employee changes jobs or joins employment. It is vital to link the UAN to your AADHAR numbers that the individual employee. If not done, the employer won’t be able to contribute to an employee’s PF account. Proper guide for using EPF to Finance Your New House.

PF Withdrawal to Purchase a Home

The Employee Provident Fund is a retirement account where those who are salaried EPFO members and employer pay as much as 12 percent of the base wage of the EPFO Member. The purpose of the EPF funds is to provide an income that will be supportive at the moment of retirement for the EPFO Member. There is also a possibility to take this money out to purchase a home or for construction. The money could be used to pay back loans for housing through an EPFO Member. But, it’s not the case that the EPFO Member can withdraw the entire amount of money from the PF account to fund housing. Some conditions are affixed to the facility. These are the following conditions following are conditions. Introduction to using Use EPF to Finance Your New House.

Suppose you want to cash out the accrued PF amount to purchase an already-move-in property. In that case, the PF withdrawal is limited to up to 36 months of the basic salary of the employee affected as well as the amount of Dearness Allowance (DA) and the price of the chosen home, which is less in value.

If an EPFO Member wants to apply to PF withdrawal to purchase an area or land plot, then the permitted PF withdrawal limit is up to 24 months from the base pay of an EPFO Member, DA included, or the price for the plot, which is the lower. For instance, 36 months of PF accrual and DA equals two lakhs, while it is the price of the plot of 3 lakh. In this scenario, only Rs 2 lakh is allowed to be removed from an EPFO Member. Look up the use of EPF to Finance Your New House.

PF Withdrawal by EPFO Member for Housing Loan Repayment

Alongside the mentioned rules, employees who are salaried EPFO members with a PF account are allowed to take out the PF money to repay a home loan. To be eligible for this benefit, the EPFO member must be a salaried worker and a PF contributor for at least ten years.

Additionally, suppose you want to repay your home loan by transferring PF funds. In that case, the withdrawal is only allowed for one year of minimum pay of the EPFO Member and Dearness Allowance (DA). To get this money, the EPFO Member must take home loans from a bank registered with Non-banking Finance Corporation or any other lender that is written. When private money is obtained from an unregistered company, this option will not be available to the EPFO Member. Take a look at using EPF to Finance Your New House.

PF Withdrawal for House Construction

In addition to purchasing an area or home, the EPFO member can also use the EPF money to build a house. To avail of this benefit, it must be required that the EPFO Members must be an active members of a housing society that is registered or registered association having a minimum of ten members. In these cases, the PF withdrawal is less than 90% of the PF amount and the cost of building the property. The building process must begin within six months of the withdrawal of PF funds through an EPFO EPFO Member. The construction should finish within 12 months of the date of departure of the last installment.

PF Withdrawal for House Renovation

An EPFO member who is a registered EPFO member has access to the benefit of PF withdrawals for home construction and mortgage repayment, among others. In addition, EPFO members who are registered EPFO participants from EPFO Employee Provisionnt Fund Organization, or EPFO, are also eligible for withdrawals from their PF account for house renovation. The EPFO member is eligible for PF withdrawal to fund improvements, modifications, or renovations of a property held by the EPFO member or their spouse or jointly owned by them. It is important to note that PF withdrawal for this scenario is only available after five years from the date of construction. To benefit the EPFO member, EPFO has made it clear that it isn’t required to renovate the home for which PF withdrawal is made. EPFO members can remodel the house in question, also. Furthermore, the PF withdrawals for renovations can be redeemed regardless of whether the EPFO Member has not taken out the PF funds for the construction of the house or purchase before.

What is the procedure to withdraw PF? (PF Withdrawal Online)

PF withdrawal is possible for various reasons, such as medical reasons, house construction, and medical reasons. It is possible to make PF withdrawls both in offline and online modes. For this info walkthrough, this topic uses EPF to Finance Your New House.

Offline Procedure for PF Withdrawal (How to withdraw pf)

To cash out from the PF balance in offline mode, utilize two forms, namely

- Composite Claim Form (Aadhar)

- Hybrid Claim Form (Non-Aadhar)

Withdrawal of PF with the help of Composite Claim Form (Aadhar)

In case you’ve seeded your Aadhar number and primary bank details through the UAN portal, and your UAN number is active, you can now use it.

Complete the form below and send it to the appropriate EPFO office without attestation from your employer.

Withdrawal of PF using Compound Claim Form (Non-Aadhar)

If your Aadhar account number and bank information aren’t linked to UAN, you can use the Composite Form. UAN Portal, you may utilize this Composite Form (Non-Aadhar).

Complete the form and send it to the appropriate EPFO office in the jurisdiction. EPFO office.

It is worth noting that various forms and documents were required under the earlier system to remove the PF balance. However, to make this PF withdrawal process more accessible, the government has eliminated the requirement to submit different forms, and the practice of self-certification by EPF employees was introduced.

Online Procedure of PF Withdrawal

- Apart from the conventional PF withdrawal process, applicants can also apply online to withdraw PF. When submitting an online application to PF withdraw, the person must ensure that the following requirements are fulfilled. It is when the Universal Account Number (UAN) is activated, and the mobile number associated with it has to be activated.

- The UAN is required to be linked to that KYC, i.e. Aadhar, PAN, etc.

How to apply online for PF Withdrawal?

Here is a step-by procedure to submit an online application to withdraw your PF.

Step 1: Log in to Step 1: Go to the UAN Login portal.

Step 2: Log in using UAN and Password, then enter your Captcha Code.

Step 3: Click the Manage tab, and then check whether the KYC (Know Your Customer) is confirmed or not.

Step 4: After verifying the KYC, go to the Online Services tab and select the ‘Claim’ (Form-31, 19, and 10C).

Step 5: On the following screen, enter your KYC information the account number, and click Verify.

Step 6: Click Yes to confirm the undertaking. Click next.

Step 7. Click on ‘Proceed to online Claim’.

Step 8: On the claim form, you must select the type of claim you want to apply for, like full settlement or partial withdrawal, in the tab “I’d like to use for.

Step 9 Then, choose the “PF Advanced Form 31′ option.

Step 10: Click the Certificate and then apply. It is possible to upload the documents. After the application has been submitted to the employer, they will need to provide their consent, and funds will be credited to your account within 15-20 days.

Should EPFO members withdraw PF money for Housing purposes?

It should be noted it is important to note that PF withdrawals to fund renovation, improvement or an addition to the existing house are limited to 12 months of basic pay and the DA. It is subject to the costs incurred for the renovation. It is important to note that the option to withdraw funds from PF by an EPFo member to fund housing-related reasons is available only once per lifetime. Although the PF withdrawal option is available for housing-related purposes, it is best not to withdraw the funds for retirement benefits.

Employed EPFO Member who contributes a PF contribution should have a UAN number. The unique UAN number is helpful in the event of a job change through the EPFO Member, PF money withdrawals, etc. Are you curious about what an EPFO member can do to locate their UAN number? Find out more here use EPF to Finance Your New House.

UAN login (EPFO Member Login): How do I know my UAN Number?

Before the introduction of the UAN facility was implemented, the EPFO was a manual operation. With an introduction of a distinctive ID number UAN (UAN Login), the computerized system has enabled the seamless UAN login for the EPFO member.

Employers can ask to give you a UAN number. It’s typically found on monthly pay slips. If you’re experiencing difficulties accessing your UAN Number, you may be able to identify your UAN on the internet.

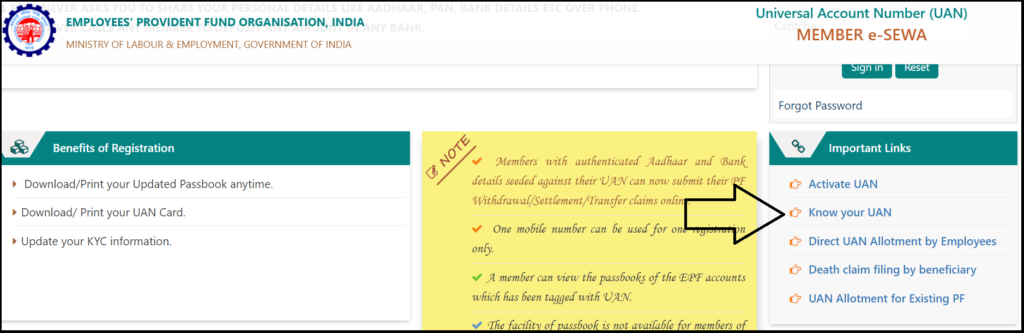

To find your UAN number Follow the steps below to find your UAN number, follow the steps below.

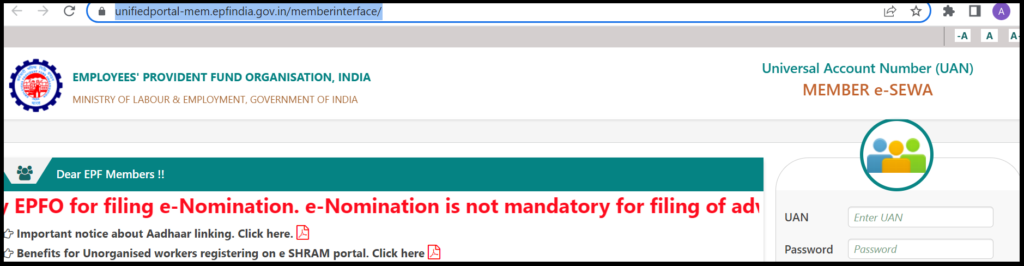

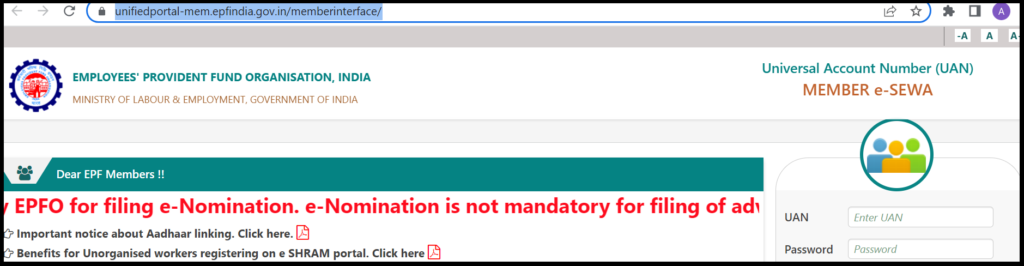

Step 1. (EPFO Login) log in to the official website of the Employee Provident Fund Organization (EPFO Homepage). i.e., https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: On the right bar, select the ‘Know Your UAN’ tab.

Step 3: Once you hit the “Know Your UAN” tab, you will be directed to the next page.

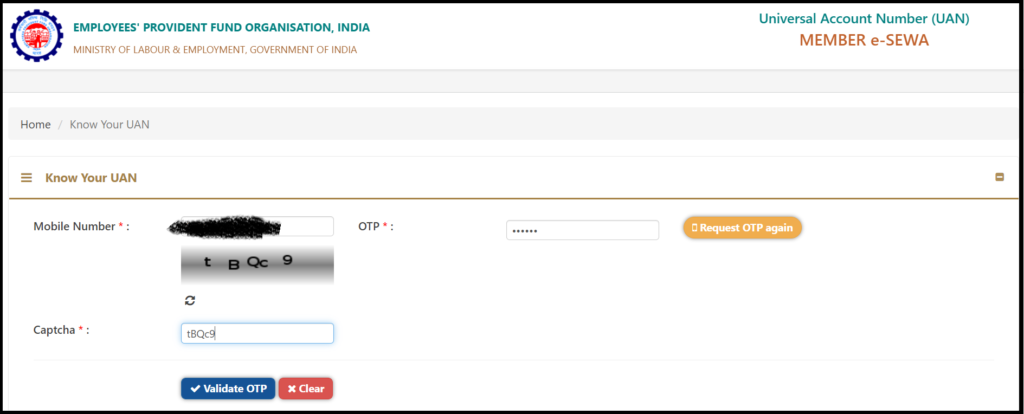

Step 4: Enter the Mobile numbers and the Captcha code and click the “Request for OTP Click on the ‘Request for OTP’ button.

Step 5: You’ll receive an OTP for the registered mobile number.

Step 6: Enter the OTP and click the “Validate OTP.

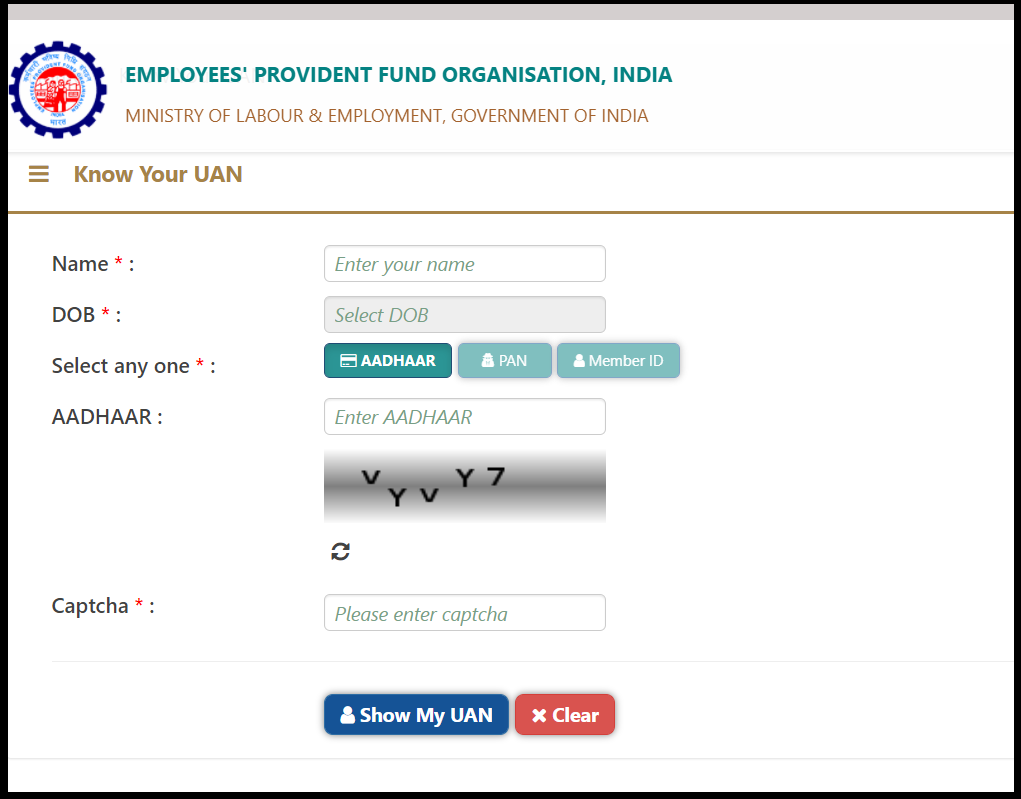

Step 7: The system will confirm that you have entered the OTP and then be directed to the next screen. (EPFO member login)

Step 8: In this step, you will be required to fill in details like Name and Date of Birth. AADHAR/Pan Card/Member’s ID, and The captcha code.

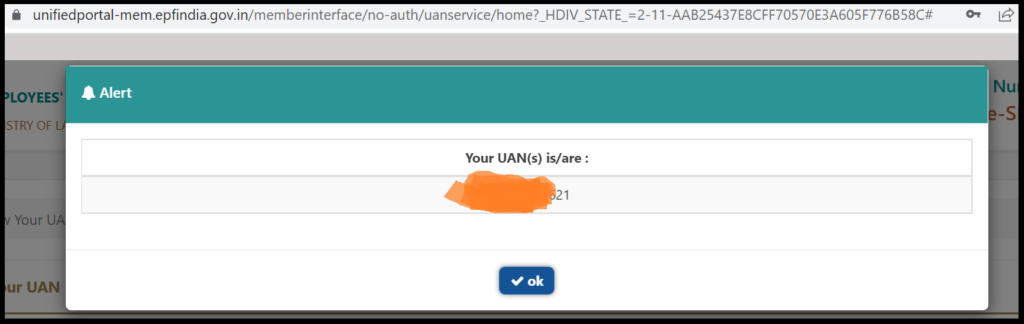

Step 9: Click the button ‘Show My UAN’. Your UAN appears on the screen.

A UAN login is necessary to access your UAN Member portal and UAN Passbook. Users can utilize the UAN to sign in to the EPFO Home portal. EPFO home portal (EPFO UAN login).

Once you have your UAN Once you have it, you can utilize it to sign in to the EPFO portal (EPFO Login). Follow the steps below to sign in using your UAN (UAN login).

UAN Login (EPFO Login): How to do UAN login on UAN portal?

Follow the steps below for UAN Login.

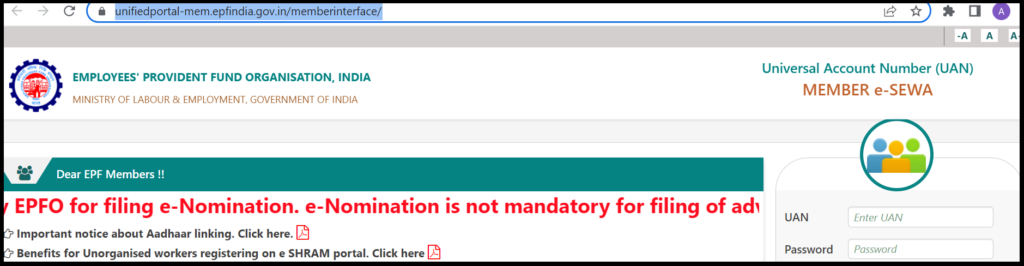

Step 1: (EPFO Login) log in to the official website of the Employee Provident Fund Organisation. (EPFO Home)

Step 2: Visit the UAN login page on the right, and enter your UAN number and password.

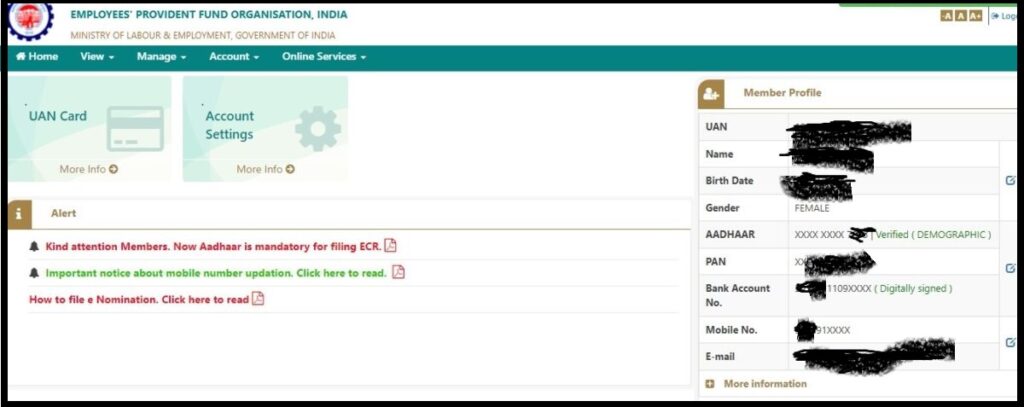

Step 3: Once you have entered your UAN along with the username and password, you will be able to access the Dashboard of the individual you’re looking for.

Step 4: The Dashboard will include information like UAN, the user’s name, date of Birth, and gender. Aadhar Pan, Number Bank Account Number, Registered Mobile Number, and email addresses of users.

Step 5: In the UAN dashboard, an individual can perform various activities, like viewing the passbook, controlling accounts, altering passwords, and downloading PDFs.

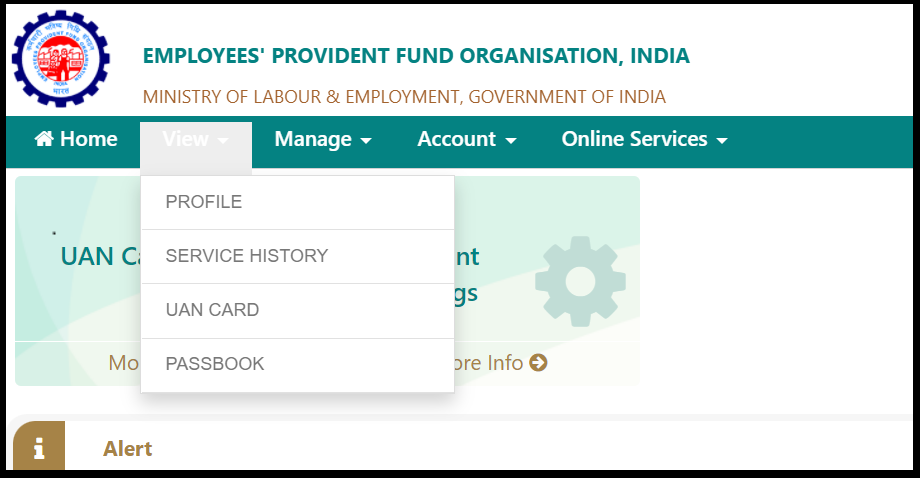

Step 6: Once you click the View button in the front, there are choices of Profile or Service History UAN Card or Passbook. You may apply for a UAN Card or open the passbook to see the balance.

Also, you can view the history of service on this page on EPFO Home.

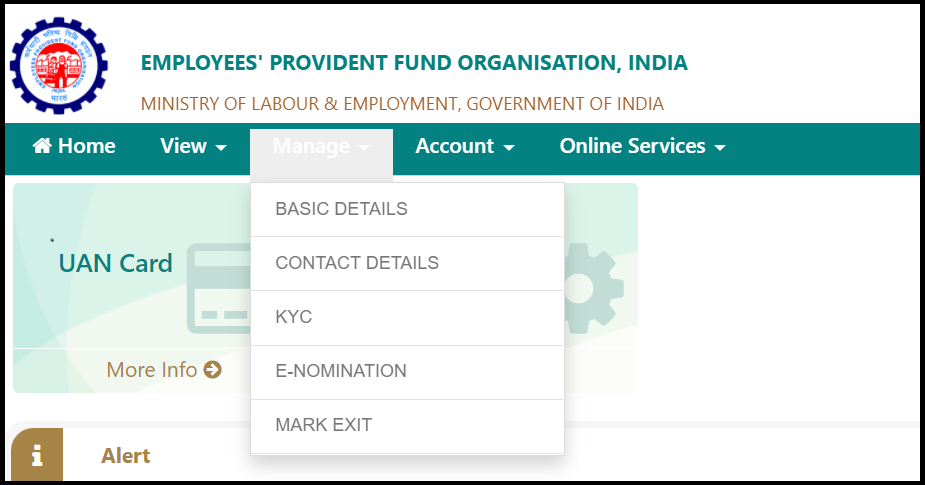

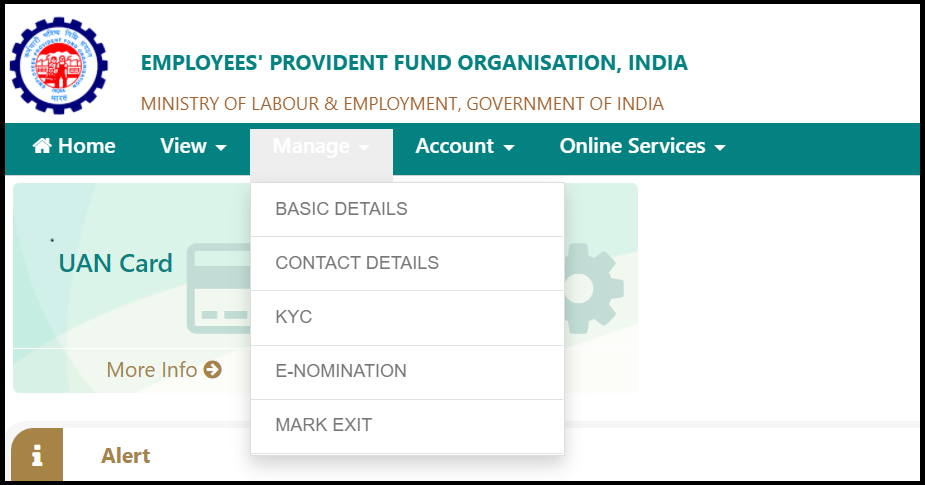

Step 7: Once you click the manage button, you will be presented with options like Basic Information Contact Information, Basic Details, Know Your Customer (KYC), and E-nominations for designating the nominee, etc.

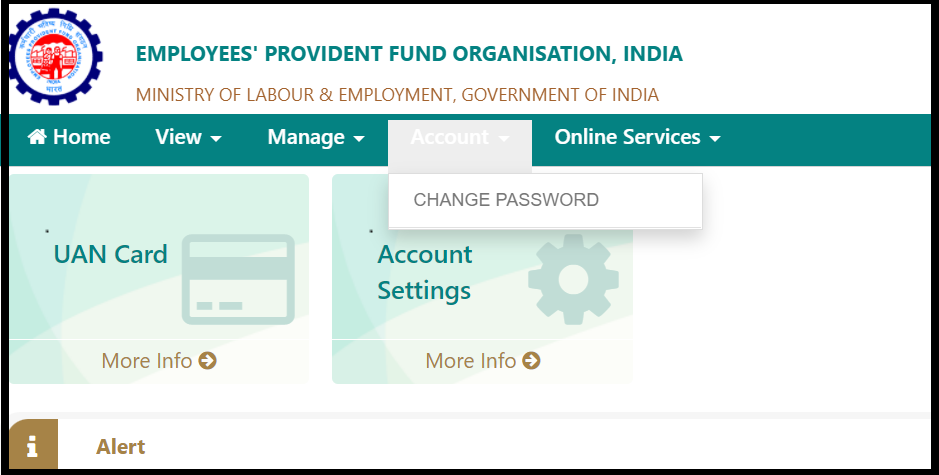

Step 8: You will be able to manage your PF account by clicking the Account button, and you can even change the account’s password.

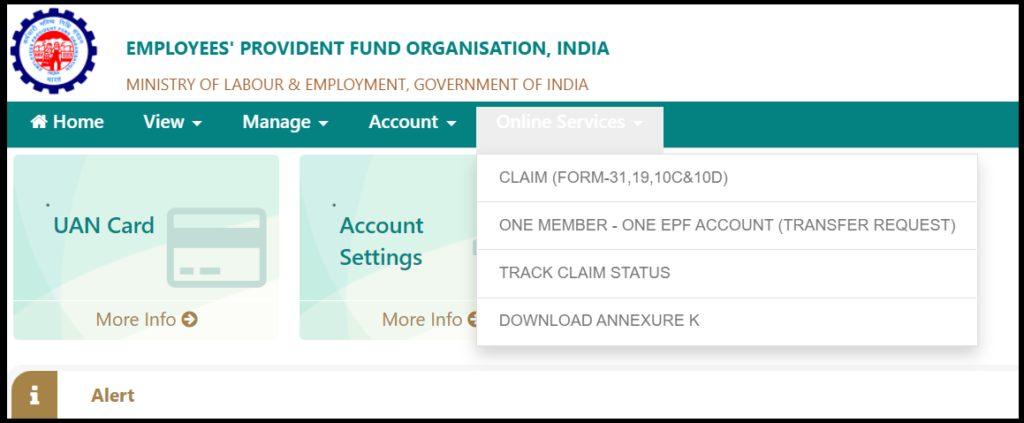

Step 9: On the tab “Online services” on the EPFO Home page, you can do the following:

- Claim for Form 31,19 and Form 10 C, and 10 D

- Request for One Member-One Account on PF

- Track Claim Status

- Download Annexure K.

As stated previously, as mentioned, the UAN numbers are the principal requirement for logging into EPFO’s portal. EPFO Portal (for an account). It should be noted that it must be activated if an employee can utilize the UAN number. Is activated.

(EPFO Member login) UAN Login: How to activate the UAN Number?

If you are an EPFO member, activating your UAN number is crucial to use the benefits offered by the EPFO Home portal. EPFO Portal Home (EPFO Login). This is the step-by-step procedure to enable the UAN number on the EPFO portal. Here you will get a brief about using EPF to Finance Your New House.

Step 1: Go to the home page for EPFO (EPFO home page).

Step 2. On the right bar, click the option to activate UAN.

Step 3: When you click the Activate UAN option, The system will be taken to the next screen.

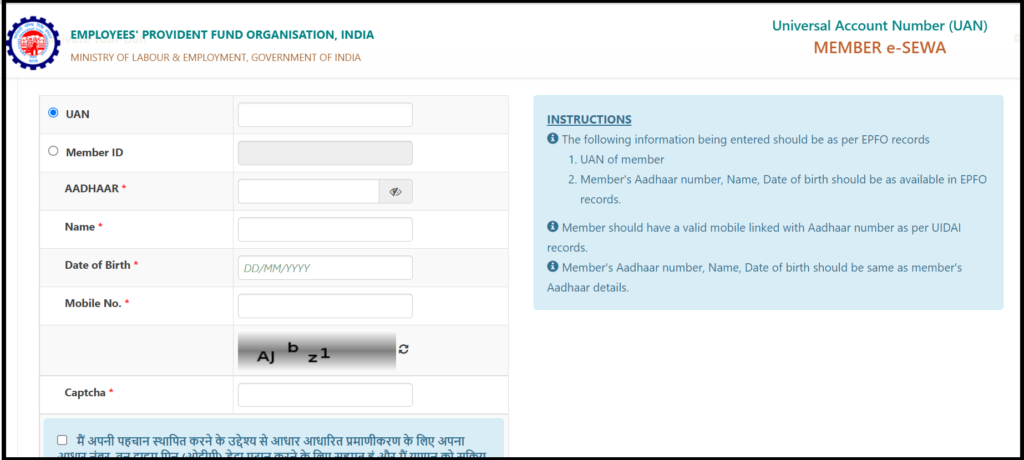

Step 4: You’ll be asked to enter the required information like UAN Member ID AADHAR, date of birth, mobile number, and the Captcha code.

Step 5: After the data is filled in, you’ll need to review the declaration. The declaration states that you have authenticated the agency using an Aadhar Number, OTP, and other essential information.

Step 6: Check the box to declare and then click on ‘Get Authorization.

Step 7: Once you’ve received the authorization number, You will need to enter it into the screen. Then your UAN Number will then be active and ready for EPFO members to log in.

UAN Passbook: How to view the EPF member passbook?

In addition to the EPFO member login And the EPFO member login the UAN number is also a way to verify the PF balance. A UAN account for EPFO can be viewed by following the steps.

Step 1: Go to the EPFO Portal’s homepage and EPFO Home (EPFO Login).

Step 2: Visit your UAN login (EPFO Member Login) on the right and type in the UAN code and the password.

Step 3: After entering your UAN along with the username and password, you can access your dashboard for the person you are referring to.

Step 4: In the UAN dashboard, an individual can do various tasks such as viewing the passbook, controlling their account’s details, modifying passwords and downloading PDFs, etc.

Step 5: Once you click the View button at the top, you will be presented with options of Profile Services History, Profile UAN Card and UAN Passbook. You may request a UAN Card or look through the passbook to see the current balance.

Step 6: Click the option to check your passbook.

Step 7: You’ll be directed to a dashboard from which you can view the UAN passbook information and monthly transactions.

EPFO Login: How to change contact details on the EPFO portal?

The EPFO member also can alter their contact information in the EPFO portal. Once you have completed the UAN Login (EPFO member Login), the contact information can be updated through the EPFO portal dashboard.

Step 1: (EPFO Login) Log in to the official website of the Employee Provident Fund Organization (EPFO Login to Home).

Step 2: Click your UAN login (EPFO Member Login) on the right and enter your UAN account number and username and password.

Step 3: After entering your UAN along with the username and password, you can access the Dashboard of the individual you’re looking for.

Step 4: click manage and then click on the contact details link.

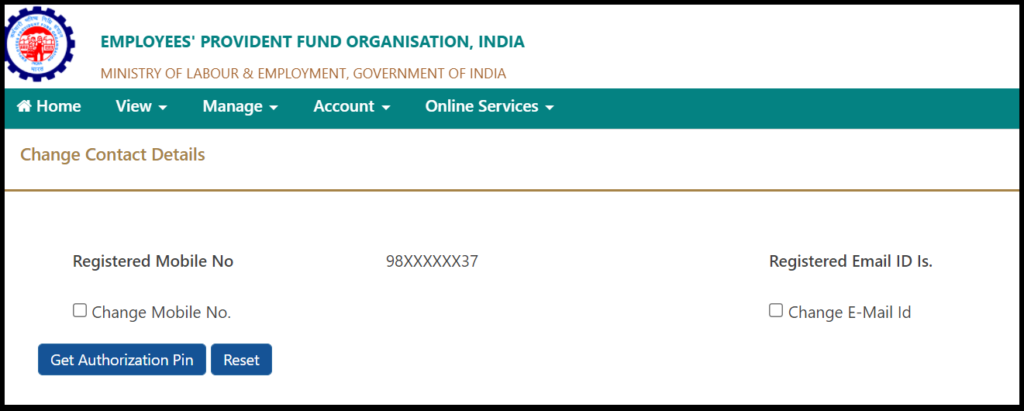

Step 5: When you have clicked on your contact information, you will be taken to the next screen.

Step 6: Select the option to change your mobile number. Enter your new number, then click the Request authorization Pin button.

Step 7: Once you have the authorization pin on your mobile, you need to enter the pin, and your mobile number will be updated to your EPFO records.

EPFO Login: How to check the PF balance (PF balance check with UAN number)

The PF is a contribution made by the EPFO Employer and Member. An EPFO Member can effortlessly verify the Balance of PF account balance (pf balance check using UAN number) using the following methods.

Via Umang Mobile application A EPFO member with a PF account and a UAN can download the UMANG application through the Google Play Store and check the PF balance using the UAN.

Through SMS – EPFO members can verify the Balance of their PF by using SMS services. The user can verify the Balance by sending a text message (SMS) to 77338299899. The structure of the letter should have the format EPFO UAN English. The last three digits indicate the language. The SMS should be sent to the registered mobile number.

Via missed call– EPFO members can determine the Balance of their PF account by making a missed call. The registered user has to make an unanswered call to 011-22901406. The Balance will be displayed at the bottom of the screen. The missed call should be made from the registered mobile number of the EPFO member only.

How to apply for home loans on EPF money?

EPFO members can repay home loans using the funds accumulated in their PF account. An EPFO member has to follow the steps outlined below to request the withdrawal of the EPF funds.

- An EPFO member can request an exemption through the Housing Society and submit it to an EPF Commissioner. The application should be submitted in the format prescribed by the EPF Commissioner as described in Annexure 1.

- To request the withdrawal, an EPF Commissioner issue a certification that outlines the monthly contribution from EPFO members.

- The EPFO members can also print their EPFO passbook and then use it as evidence of their contribution.

- It is important to note that the EPFO directly supports the institution (private or public).

- EPFO members can choose PF withdrawals in a lump sum or as EMIs.

What are the documents required for PF withdrawal?

- If an EPFO member wishes to make a PF withdrawal, the documents listed below must be signed together by an EPFO member.

- A Universal Account Number, or UAN, is the essential prerequisite. The UAN is noted on the EPFO member’s passbook, or the employer obtains it.

- Bank account information (Like the Passbook) belongs to an EPFO member. The EPFO member’s name must be the same for and on both of bank account and the EPFO member account as well as the bank account.

- The account has to be registered in the name of the EPFO member since the money can’t be transferred to a third party during the time an EPFO member is living.

- Personal details belonging to an EPFO member should be identical to the identification proof and EPFO member account.

How to make a PF withdrawal using the Old form?

As per the new PF withdrawal regulations, EPFO members can apply for PF withdrawal using the older form.

Step 1: The EPFO member needs to contact the HR department at the previous employer and request Form 19. The EPFO member may also download it via the EPFO portal.

Step 2: Complete the form with EPFO account details, UAN details, bank account information, IFSC code, etc.

Step 3: A canceled check to the bank account to be used for reference.

Step 4: Send the form you have filled out to your employer.

Step 5: The employer must sign off on the application and forward the form to the regional provident fund office.

It’s a manual process and requires some time. The application is made online, and the progress of the request can be monitored.

How to Generate Direct UAN via EPFO portal? (Step-by-step)

Employees Provident Fund Organization (EPFO Home) utilizes its Universal Account Number (UAN) to offer all services associated with the fund. The EPFO provides the option to create UAN directly using the EPFO portal. To make the UAN directly from the EPFO portal follow this steps to follow the steps.

step 1: (EPFO Membership Login) Visit the official site of the Employees Provident Fund Organisation (EPFO Portal), i.e. https://epfindia.gov.in/site_en/index.php (UAN Login)

Step 2: On the left side of the screen, select the option “Direct UAN allotment to Employees.

Step 3: In this stage, Enter the Aadhar number you have registered. Aadhar number.

Step 4: The Time Password (OTP) will be sent to the mobile number registered.

Step 5: Step 5: Enter the OTP. The system will then get the details that are registered with UIDAI.

Step 6: Click”Register.

Step 7: UAN can be created and shown on screen. The newly created UAN will be sent to the registered mobile as well.

How to get UAN for an existing PF account (EPFO Member Account)?

EPFO or the EPFO (also known as Employees Provident Fund Organization (EPFO Home) utilizes the UAN to record the information of the employee provident funds accounts. If you already have a Provident Fund account but do not have a UAN, then you can obtain it from the EPFO portal. Follow the steps below to receive the UAN for your existing PF account.

Step 1: Go to the website of EPFO Home @https://unifiedportal-mem.epfindia.gov.in/member interface/ (UAN Login)

Step 2: On the right-hand side, Click on the UAN allotment to the existing PF.

Step 3: You’ll be taken to a page. Enter the AAdhar mobile number, and you will be prompted to enter the Captcha Code.

4. In the subsequent step, type in the details belonging to the EPFO Member whose PF account is already established.

Step 5: When you’ve filled in your details, click the Proceed button. Your current account will be upgraded to the permanent UAN. In the future, all EPFO-associated information can be accessed only through the UAN.

How to Check EPF Interest Amount in PF Account Using EPFO Online Portal

Here are a few easy steps to help you verify your EPF interest balance within your PF account using EPFO’s online portal. EPFO web portal.

Step 1: Log in to the EPFO login page at epfindia.gov.in

Step 2:Click the option “For Employees” within the menu Services

Step3: Click the Members Passbook option listed in the Services section.

Step 4: Enter the UAN account number and the password to open your PF account’s passbook. The amount of interest will be displayed on the same page.

Step 5: Find your EPF account passbook on the screen. You can check your EPF interest amount in the same.

Latest Updates regarding EPFO Portal

The Employee Provident Fund Organization (EPFO) is contemplating the possibility of creating a Central Pension Disbursal System. The system will allow the organization to distribute pensions to all pensioners throughout India in one step. It will benefit more than 73,000 people who are pensioners in India. Under the current system, over 138 EPFOs distribute pensions differently within their region. This means that pensioners across the areas receive pensions on different days and at other times. The new system will use the pensioner’s information at the 138 EPFO offices. The proposed method is expected to reduce the time required to disburse pensions and help in saving money and time. EPFO will enlist the assistance of the Centre for Development of Advance Computing (CDAC) ‘s assistance to implement this IT-powered infrastructure. This proposed system will allow the merger and elimination of the entire PF account of any member. It will also eliminate the requirement to transfer the account upon changing employment.

Conclusively, The EPFO Login (EPFO Member Login) helps a user verify their PF balance through UAN. This UAN login lets a user log in to the online dashboard and uses services like EPFO passbook check, contact information changes, and tracking what is happening with claims. The UAN login (EPFO Member Login) has indeed streamlined the EPFO portal services.

Also Read: 20 DIY Garden Decoration Tips – Inexpensive and Easy

Similar Topics : What is BHK? – An Essential Guide With BHK Full Form & Meaning