You ought to have a bank nominee if you have a bank account. Let’s examine what a nominee is, who qualifies as a candidate, the significance of a nominee, and how to modify or replace the nominee for your bank account. In this blog, we will see Meaning of Nominee – All About Bank Nominee in India.

After all, the earning member or members of each household bear a heavy burden for the dependents. They must choose one of the members to serve as the bank nominee in addition to taking care of all other needs. Not only that, but they would also need to explain to the family members the nominee’s rights in a bank account in case of any unfortunate catastrophe.

Let’s consider an example. Mr A, the famous lawyer, made enough money working for banks and other businesses to retire comfortably. He passed away from lung cancer as a result of an unanticipated decline in health, leaving behind his elderly wife. After the funeral rites, Mrs A discovered herself without access to the enormous quantities of money her husband had made, leaving her bankrupt. Being a member of HUF, the extended family took care of her housing and food needs, but she had nothing in her possession or a safety net. Complete the bank formalities. It took her more than a year. This occurred as a result of Mr A’s error in failing to designate his wife (or anyone else) as the nominee.

Find out who can be a nominee in bank accounts and other investments and how to go about doing it to prevent such a predicament for your loved ones.

What does Nominee mean?

A nominee is, by definition, a person or organization trusted with another holder’s assets while the holder is away. The nominee’s financial obligations to the insured/original owner of the assets are simply transferred to this person. A nominee can serve as a custodian in legal affairs and a safe keeper in financial matters. The insured designates a different individual to receive the insurance benefits.

Why a Bank Nominee is Important

According to the RBI, there are countless amounts of unclaimed deposits sitting in banks all over India. This is because these accounts had no bank nominees, and it is incredibly challenging to get money back without a nomination. The deceased person’s family, who may have provided the family with financial support, must deal not just with their grief but also with a sudden loss of stability. This confusion can be resolved by designating the spouse or other family members as the bank nominee.

A bank nominee is therefore essential in your bank account, so at the very least, your loved ones’ interests are safeguarded in the event of any unanticipated circumstance to you.

Who can be a Nominee in Bank Account

Account holders frequently seek guidance when deciding who can be a nominee in a bank account. Your nominee should be the one you wish to receive the money in the event of your passing; this individual could be your spouse, children, sibling, or either of your parents or another relative. Ensure that the person you designate as your nominee does not differ from the person you name in your will. If the candidate and recipient specified in the will disagree, they may need to resort to litigation to settle.

How many nominees are allowed? The next nomination-related concern is the number of candidates that can be held in a bank account. When a couple has two kids, they frequently wish to name both, or you can consider naming one child with your spouse. You may only nominate one individual for nomination in a bank account. There may be two nominations for some jointly controlled “locker” accounts.

If the candidate a child? You must choose a guardian if your nominee is a minor. If your nominee is a minor, the bank must give the guardian the money when you pass away.

Nominee Rights versus Legal Will

Unless otherwise specified in a Will, the bank will assume that your nominee is the person you intend to leave your money to. Therefore, nominee rights in a bank account often mean that the person you choose will receive all of the account’s earnings.

If the legal successor (in the Will) and the nominee are different people, the nominee’s rights in the bank account are limited to those of a custodian. The nominee’s responsibility would be to take the money from the bank and give it to the rightful heir. Your heir may petition the courts based on your Will if your nominee declines to follow suit.

What Happens if There is No Nominee

What occurs if the bank nominee is absent when the account holder dies? Banks want the money delivered to the lawful heirs as quickly as possible. Your bank will transfer the funds in your account to your heirs if you have a will that names one or more of your legal heirs. Suppose the owner passes away without leaving a will, and there are no disagreements among the legal heirs. In that case, they may claim the money (principal and interest) from the bank by providing the necessary paperwork. The required documents will determine whether the claimed amount is 5 Lakhs or higher. The following must be given to the bank by heirs:

the KYC of

Certificate of Death Photocopy

letter of indemnity with a stamp (COS 540)

All claimants have signed the updated claim form.

Declaration on the Revised Claim Form, signed by a government representative or a customer of the same bank.

Declaration of Letters

If the sum exceeds Rs. 5 lakhs, the Declaration in the Revised Claim Form is sworn in front of a Judicial Magistrate or Notary Public as an affidavit in COS 539. In addition to the previously mentioned documents, Sureties with their contact information are also required.

How to Declare a Nominee

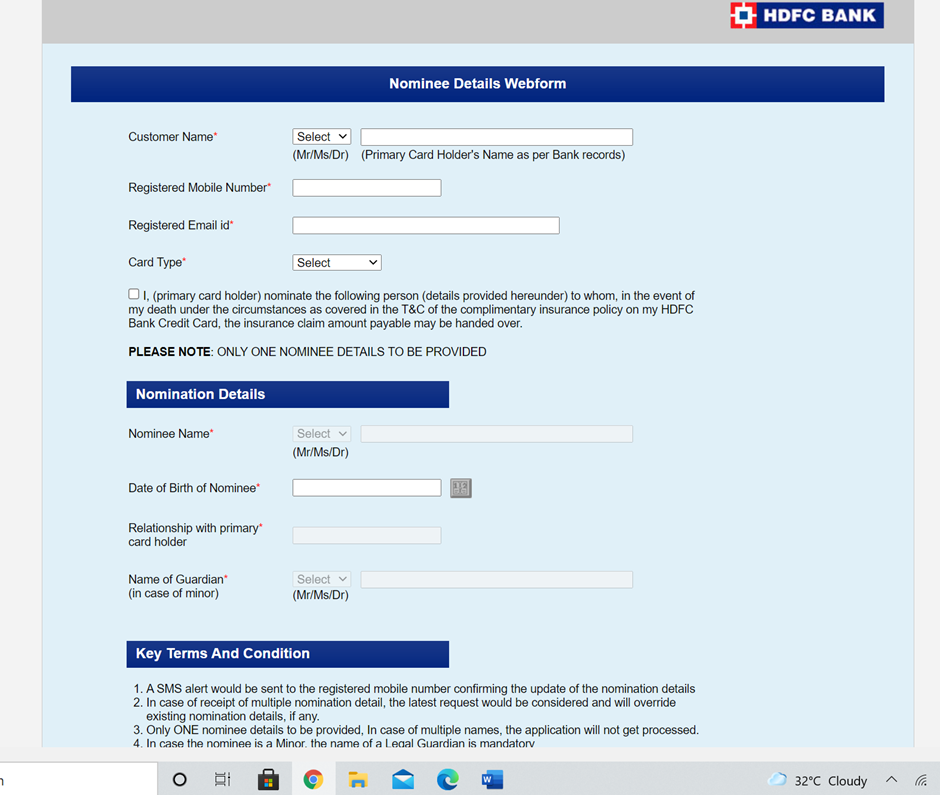

You can choose a beneficiary for your bank account in various ways. Bank representatives can assist you in filling out an application for a nominee in the bank if you visit the branch. Both online and offline techniques are available.

Most banks’ official websites include an online version of the nominee in the bank application. Go to the website, choose the choice, choose or input the account number, enter the nominee’s information, and submit. You would also locate an application for the nominee in the bank there if your bank provides mobile app services. By clicking the option, choosing the account number, entering the information for the nominee, and then submitting, you can submit the request using the app.

How to Update Nominee in Bank Account

In simple steps, your bank will walk you through upgrading or changing a nominee’s status. This is something that both privately owned banks and nationalized institutions can do with ease.

Let’s imagine you’ve had an ICICI Bank account before getting married and want to add your spouse as the nominee now that you’re married. You can fill out the DA1 form in person at your branch. Visit the bank’s website if you need help adding a nominee in ICICI Bank online. There are three steps to adding your nominee after logging in. You need to log in later to see if that has been reflected.

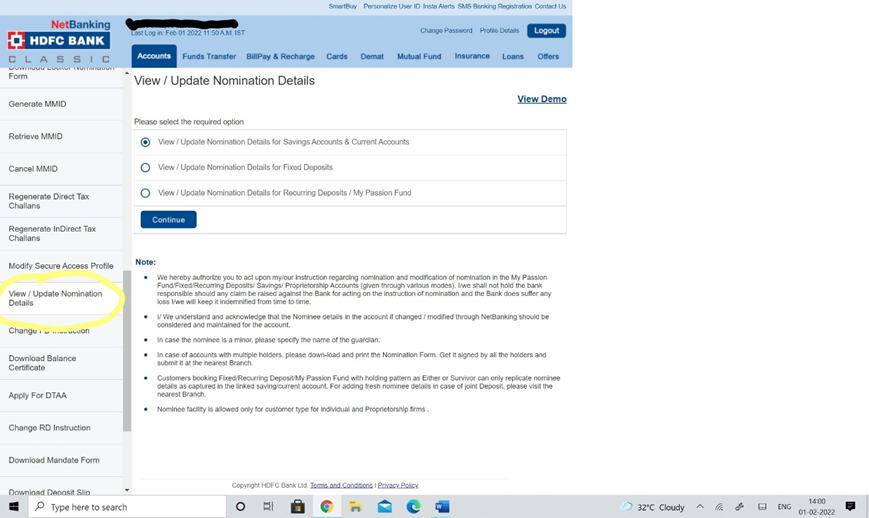

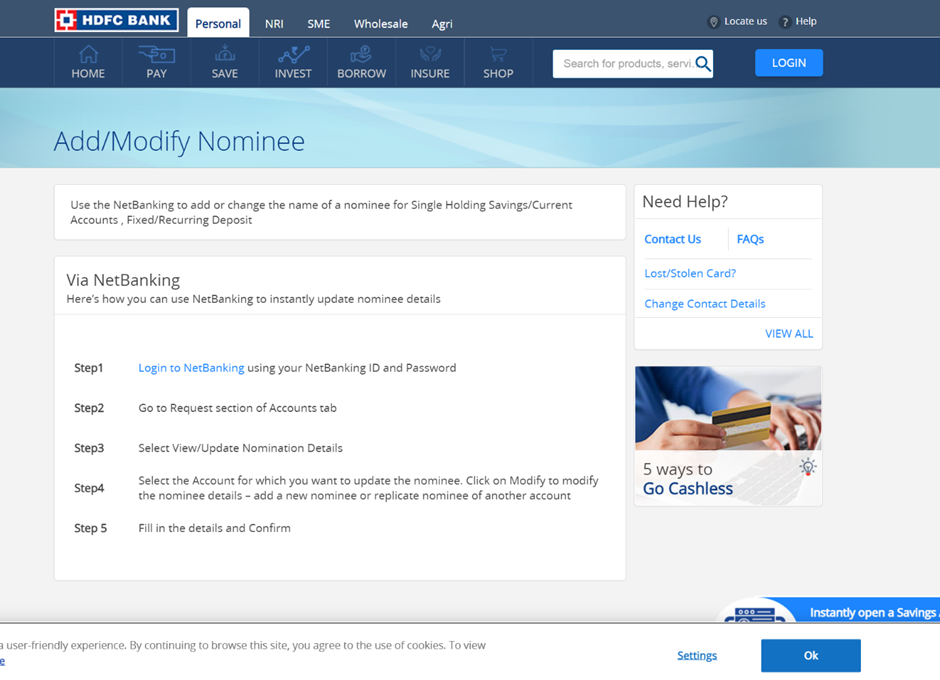

How to add or modify nominee online for HDFC Bank

If you are a customer of HDFC Bank, the process is equally easy and you can easily figure out how to update nominees in HDFC Bank online.

Assume you want to replace your sister with your spouse or child as your candidate. If you have an account with HDFC Bank, stop worrying about changing the nominee in HDFC Bank and go to the branch to request Form DA3, the nominee alteration form. Let us explain how to alter the nominee in HDFC Bank if you want to avoid visiting the branch. You need to click the Request section on the Accounts page after logging in, then select Update Nomination Details before selecting your Account. Select the Modify tab next, enter the new information, and submit.

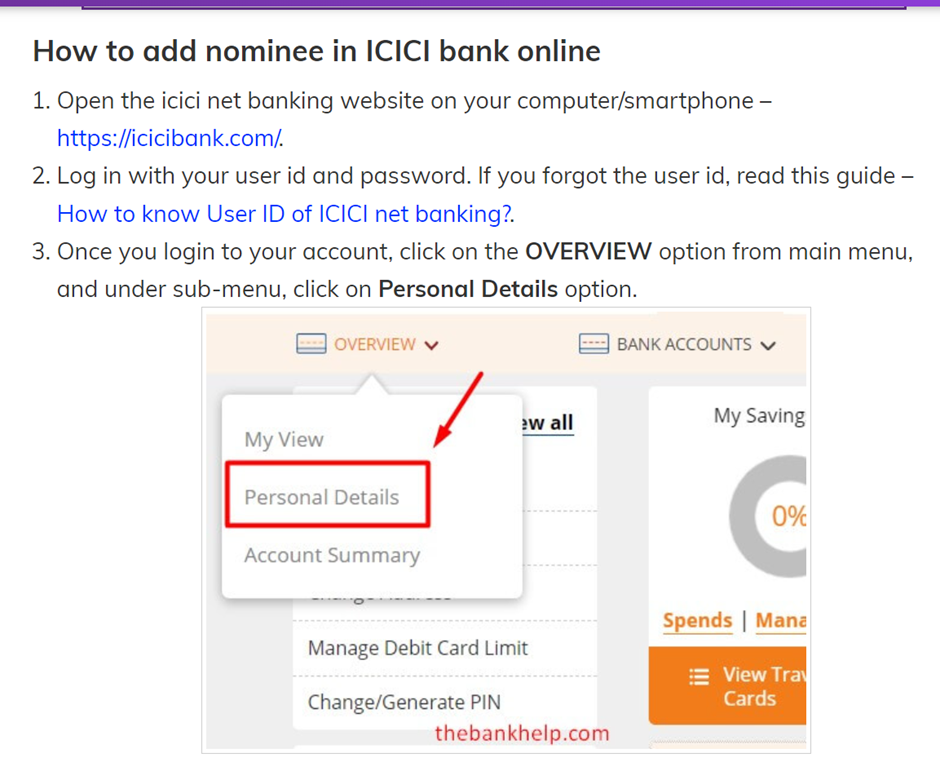

How to add or change nominees online for ICICI Bank

Do you require assistance in changing your nominee in ICICI Bank Online? Once you log in, the procedures are identical. If many accounts are in the same branch, be sure you are making the correct adjustment. I’m assuming you know how to check a nominee in ICICI Bank. You can choose each account and check the nominee listed in each one before making the needed adjustment.

The last word on the nominee in the bank account

Your loved ones and others who depend on you will be financially secure if you add a nominee to your bank accounts. If you still need to choose your nominee, please do so as soon as possible. Visit your account again to review the status and make any necessary modifications if you completed it a long time ago. Refrain from stressing about adding a nominee in HDFC Bank or updating a nominee in ICICI Bank online. Everything will be a piece of cake if you visit the branch, schedule a call with their customer service, or visit the website. Last but not least, remember to let your nominee know they have been nominated.

Also Read: Supertech Twin Towers Demolition & The Causes Behind It

Similar Topics: Illegal Construction Demolition: All You Need to Know