The phrase “home sweet home” is well known to everyone. A place to call your own brings immense comfort and a sense of belonging. While buying a home also results in low cash flow, it definitely benefits economically in the long run.

We sure have our checklist ready about the colour scheme of the walls, and what kind of interior décor we should go for but not so much about the process, factors to consider and lengthy paperwork.

The requirement to have enough money on hand while planning to acquire real estate is the first thing that comes to mind. The biggest asset that a person often purchases is a house. It may take many years to save up enough money for this buy. You don’t have to wait this long, though. To buy your home, you can only take out a home loan. By doing this, you can benefit from home ownership right now rather than having to wait a long time.

Banks offer home loans with the mortgaged property serving as collateral. In addition, the bank with due diligence on the property performs by examining all ownership rights and other relevant papers.

While this doesn’t relieve the buyer of the duty to do their own independent review of the property records, it does give them some additional peace of mind regarding the property’s high level of certainty.

Here’s a checklist to follow while drawing up your plan for buying a home:

Setting the budget

Setting a budget is the first and most important task. You must determine how much cash you can afford to spend on a home without going crazy. You should at least have 50%-60% savings to contribute towards your dream house. Check-in with different banks and be very sure of your footing when it comes to applying for a home loan which caters to your benefit. Employees at banks are eligible to take advantage of appealing benefits that banks provide. Higher loan amounts, more lenient eligibility requirements, cheaper interest rates, and longer payback terms are all options for house loans

Selecting a suitable location

List the areas where you want to make investments in due course of time. Discuss your family members’ preferences and conveniences with them. Check the distance between your workplaces, if both you and your wife work, and estimate how long it would take your child to commute to school. Check for nearby basic amenities like hospitals, banks, and shopping centres if you live with elderly parents. Living conveniently close to the main roadway is always beneficial because it allows for easy access to public transportation. Read evaluations of the area, speak with the locals, and find out if water and electricity are available, if any new projects are planned, etc.

Document verification

Check the sale deed if you’re preparing to purchase a readily available apartment. The sale deed is the first entity on the home-buying checklist because it is the official document that serves as evidence of property sales and transfers. It is advised to carefully read the deed before signing it.

Ask and verify the completion and occupancy certificates, which were issued by the relevant local government organisations and municipal authorities, respectively. Prior to disbursing the loan, banks will request these papers. To avoid any future issues, make sure the building plan has received the approval of the local authorities.

Look up the Hidden costs

Don’t overlook the section on hidden expenditures when buying a home. In addition to the property’s cost, there are additional expenses related to the purchase. These include Goods and Service Tax (GST) on ongoing construction projects. Additional fees such as registration fees and property taxes must be paid. Therefore, consider these extra costs before deciding on a budget and clarify them with your builder.

Applying for a Home loan

You might choose to take out a loan once you’ve made up your mind to buy a house and have finalised the deal on the property. The interest rate on home loans is lower than that of other loans. The applicant must submit several documents to prove their KYC in order to apply for a house loan. For speedy processing, maintain the following documents close at hand:

• Passport-size photographs

• Identity proof

• Address proof

• Bank account statement

• Liability Statements

• Property documents

• Salary certificate

• Form-16, IT Returns copies

RERA Certification

An official RERA (Real Estate Regulatory Authority) certificate is given to a property, project, or property agency as evidence that they have been registered with the state-level RERA authority. On the RERA certificate, there is a registration number that enables them to lawfully conduct their business. The entire project, developer, and property information is contained there. This certificate lowers the likelihood of fraud and protects buyers’ rights. Therefore, it is essential to include examining the RERA Certificate on your priority list.

Other Real estate offers

Extensive market research is essential to ensure that you pay the appropriate price for the home you have chosen. Check the trends in local home prices by visiting several websites. Additionally, look up the historical rate of property inflation. It is a warning sign if the price has decreased in recent years. You can determine the true value of the property by researching local pricing patterns. Once you are satisfied with your research, You are ready to move ahead with signing off the papers.

Signing the deal

The “Agreement of Sale” stipulates terms that are agreeable to both parties and states that the property will be given to the buyer. The Builder Buyer Agreement is a legal instrument that has been defined by the Supreme Court (BBA). To guarantee more openness in real estate transactions, this agreement adheres to a prescribed format. The buyer’s interest will be protected, putting an end to random and unfair contracts.

Property registration Process

Registering the Sale Deed is the final action item when buying a home. A sale deed is made after the sale agreement.

Keep all the paperwork prepared before the registration day. Plan your day by looking up the sub-office registrar’s hours.

Deposit the registration fees and stamp duty in advance. These are payable online. Through this process, your attorney can assist you.

Additionally, you’ll need two witnesses who will sign the papers. They are required to have their Aadhaar Cards on them. Make sure to invite witnesses who you are quite familiar with.

A document demonstrating that TDS has been subtracted from the property value is required if the value of the property exceeds Rs 5,000,000.

The receipt will then be supplied to you. Your documents will normally need to be registered within 15 days.

Home Insurance

To safeguard your home against risks caused by nature or humans, home insurance policies were developed specifically for this purpose.

Naturally, protecting your home from potential damage or losses is the main benefit of purchasing home insurance coverage. Your house insurance coverage will cover the costs if, for example, a tree fell on your roof or someone drove into your boundary wall by mistake.

The majority of the time, a home insurance policy will also cover your home’s contents, including furniture, furnishings, valuables occasionally, and appliances (such as refrigerators, televisions, computers, air conditioners, microwaves, etc.). Read the terms and conditions carefully while finalising the paperwork for home insurance.

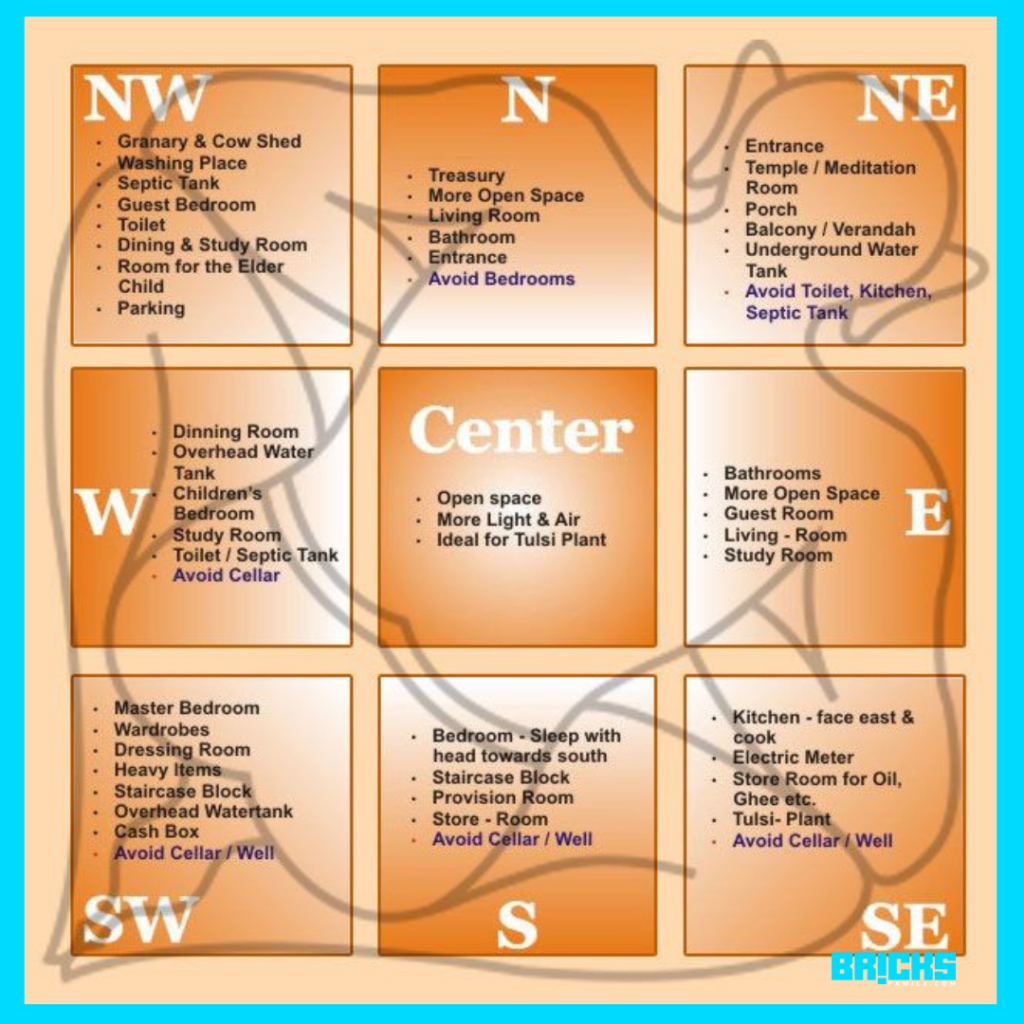

Vastu Shastra

Vastu connects man with nature.

If you are building a home from ground scratch, you must consider utilising the elements and energy fields of nature to their most potential while designing a home or workplace. Vastu Shastra aligns the five natural elements and directions with us and our living area by balancing them.

Include this item on your home-buying list to increase the value of your house. When purchasing a home, one should adhere to the vastu principles.

You may want to read: Home Design Plans as per Vastu: Here’s What You Need to Know

and If you are planning to buy an apartment then, Vastu Tips for Flat in a City

Final note: Why buying a home is better than renting a place

You feel emotionally safe in your own house since it is a place where you are free to be who you are. You don’t have to deal with a landlord and any potential hassles because you have the comfort and permanence of your own house. Your home is a priceless asset with the potential to appreciate in value over time. It makes sense to avoid delaying your house purchase because doing so could result in larger cash outlays owing to property value growth.

Commercial real estate developers can be confident that their assets give them the required protection even though analysts disagree on whether this inflationary surge is transitory or permanent.

Multiple studies conducted over the past few decades have demonstrated that private residential property returns remain stable in times of inflation.